How does the bitcoin source code define its 21 million cap?

Many of bitcoin’s staunchest critics have expressed doubt about its 21 million cap, but perhaps the most mindless criticism relates…

,

Let’s start with what not to do.

The worst thing you can do when buying bitcoin is “bite off more than you can chew.” People often overestimate their knowledge, conviction, or fortitude and buy more bitcoin than they can realistically hold on to. Eventually, the dollar price swings down, buyers lacking a fundamental understanding of bitcoin become shaken in emotion or circumstance, and they sell at a loss with a bitter bitcoin taste in their mouths. They leave bitcoin and vow never to return.

That is, until the inevitable price runs up again and catches their attention, resentment and FOMO set in, and they rinse and repeat, starting the vicious cycle with another big bite. I’ve seen it, and I’ve done it. Human nature often gets the best of us.

The short answer for how much bitcoin you should buy is: Not too much. To make sure buying “too much” doesn’t happen to you, consider yourself and your circumstances across the following three dimensions:

“The time you first buy bitcoin, your understanding of bitcoin is necessarily limited… part of the understanding is experiencing it over time.” – Parker Lewis

Nobody understands bitcoin the first time they encounter it. As you grow in your understanding of bitcoin, there are two essential questions to ask:

Nobody understands bitcoin the first time they encounter it. As you grow in your understanding of bitcoin, there are two essential questions to ask:

Your depth of understanding regarding these two questions will increase your conviction to hold through volatility. Bitcoin education is a never-ending rabbit hole, but most long-term savers in bitcoin choose to save in it for a few primary reasons:

If you’re looking for somewhere to start, we recommend beginning your journey with the Gradually, then Suddenly series.

“Start with why…” – Simon Sinek

It is crucial to know the “why” behind your bitcoin purchase. If the bitcoin is not tied to a goal, both bull and bear markets can cause you to sell before you originally intended. Answer for yourself: What is the money for, and how long will I hold it?

It is crucial to know the “why” behind your bitcoin purchase. If the bitcoin is not tied to a goal, both bull and bear markets can cause you to sell before you originally intended. Answer for yourself: What is the money for, and how long will I hold it?

Do you want to make a quick buck? Put a down payment for a home in 2 years? Retire in 30 years? Pass down generational bitcoin to kids and grandkids? If your goal is distant, you’ll be less likely to sell at a loss.

It is also essential to consider your cash flow and short-term cash savings. Even with its high inflation, USD cash purchasing power is far less volatile on a month-to-month basis than bitcoin, and often necessary for monthly expenses. Said differently, you most likely won’t pay next month’s mortgage payment in bitcoin.

If you were to have a significant unexpected expense or income loss tomorrow, would you need to sell bitcoin when you weren’t expecting to? Holding on to volatile assets for long periods of time is a game of survival. The best way to plan for the unexpected is not to have all your eggs in one basket. Make sure your short-term needs are adequately covered.

“Everyone has a plan until they get punched in the mouth…” – Mike Tyson

Risk tolerance describes your capacity for dealing with volatile prices. If you’ve never experienced steep drops in price, you won’t fully know how much you can handle.

Risk tolerance describes your capacity for dealing with volatile prices. If you’ve never experienced steep drops in price, you won’t fully know how much you can handle.

Although it can grow over time, risk tolerance is not something you can force yourself to increase. To some degree, it’s just the “emotional cards you’re dealt.” Knowing how to play your cards is your only way forward. Take an introspective look at yourself.

These questions can be insightful in understanding how you’re emotionally built:

Be honest with yourself, and don’t bite off more than you can chew. As our own Phil Geiger puts it: “Holding bitcoin is the feeling of being punched repeatedly in the stomach for years until you’re wealthy.”

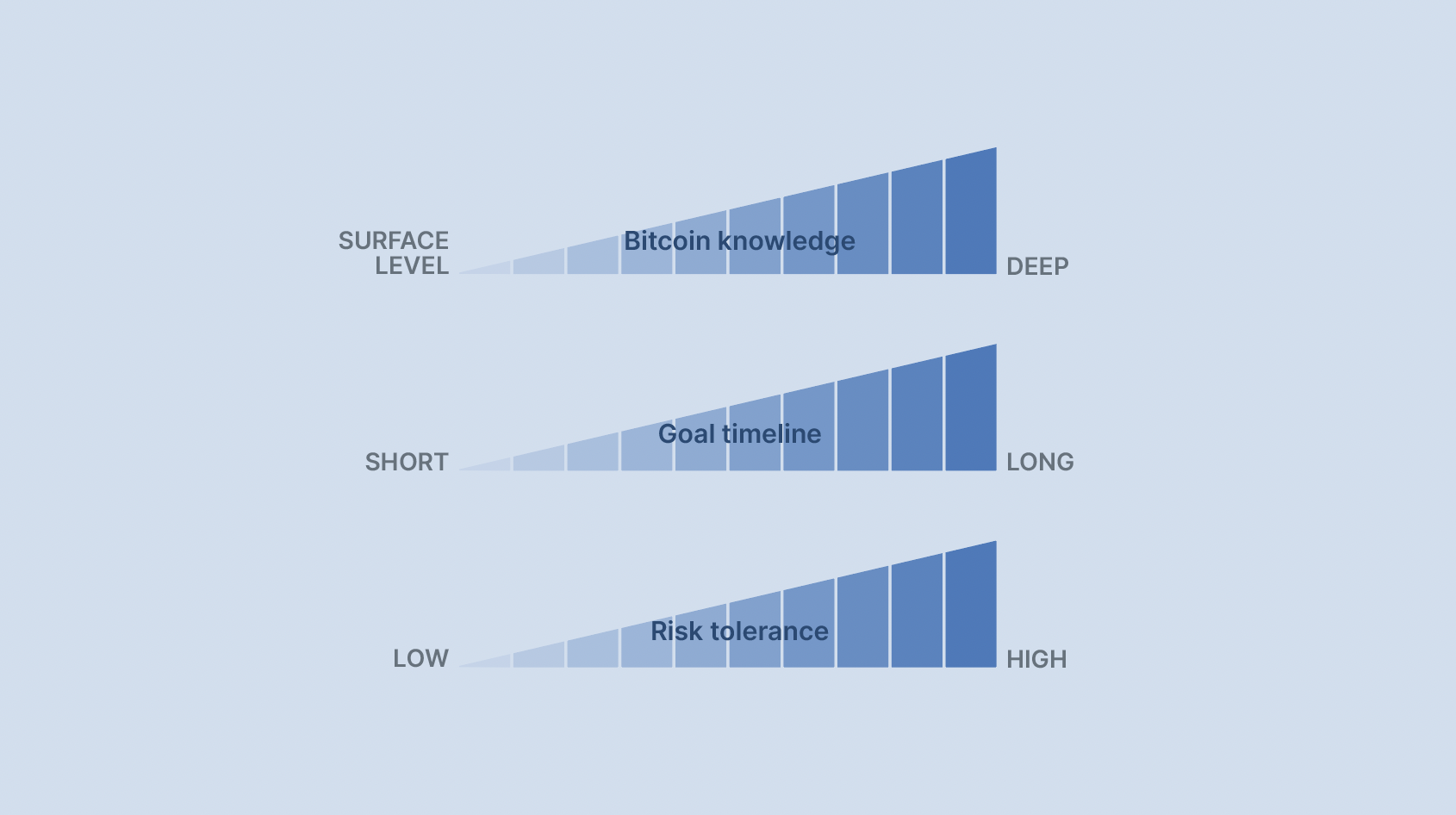

It’s better to start small and gradually increase your exposure to bitcoin rather than taking on too much at once. When deciding how much bitcoin to buy, it’s important to consider your understanding and knowledge of bitcoin, your goal and its timeframe, and your risk tolerance.

As these three factors (knowledge, timeframe, tolerance) increase, your perspective on what bitcoin is begins to change. What bitcoin means to you becomes different than what it means to others. You’ll become increasingly comfortable with the portion of your finances dedicated to bitcoin.

As these three factors (knowledge, timeframe, tolerance) increase, your perspective on what bitcoin is begins to change. What bitcoin means to you becomes different than what it means to others. You’ll become increasingly comfortable with the portion of your finances dedicated to bitcoin.

If you’re interested in the different stages of personal bitcoin adoption, see our article where we’ve outlined some major stepping stones and perspectives on buying bitcoin. And if you’re ready to start buying bitcoin today, we have another article dedicated to helping you weigh the various means by which you can do so.

As you can see, there’s no one correct answer to the question, “how much bitcoin should I buy?” However, if you follow these principles, you’ll be able to make a better-informed decision that fits your unique needs.

This article is provided for educational purposes only, and cannot be relied upon as tax or investment advice. Unchained makes no representations regarding the tax consequences or investment suitability of any structure described herein, and all such questions should be directed to a tax or financial advisor of your choice.

Many of bitcoin’s staunchest critics have expressed doubt about its 21 million cap, but perhaps the most mindless criticism relates…

Ted Stevenot, Stephen HallWhen Satoshi Nakamoto created bitcoin, he established in its code a fixed number of bitcoin that will ever exist. Since…

Ted StevenotOriginally published in Parker’s dedicated Gradually, Then Suddenly publication. Bitcoin is often described as a hedge, or more specifically, a…

Parker Lewis