How does the bitcoin source code define its 21 million cap?

Many of bitcoin’s staunchest critics have expressed doubt about its 21 million cap, but perhaps the most mindless criticism relates…

,

In a healthy market, volatility is the price you pay for growth. No pain, no gain. If bitcoin continues to grow, it will likely continue to be volatile. Volatility is expected since bitcoin has a fixed supply of 21 million and organic growth from one person in 2009 to millions of users today. That said, there are some strategies you can use to manage bitcoin’s volatility—and your own emotions—as it continues to grow. Consider these six concepts as you learn to embrace the bear markets.

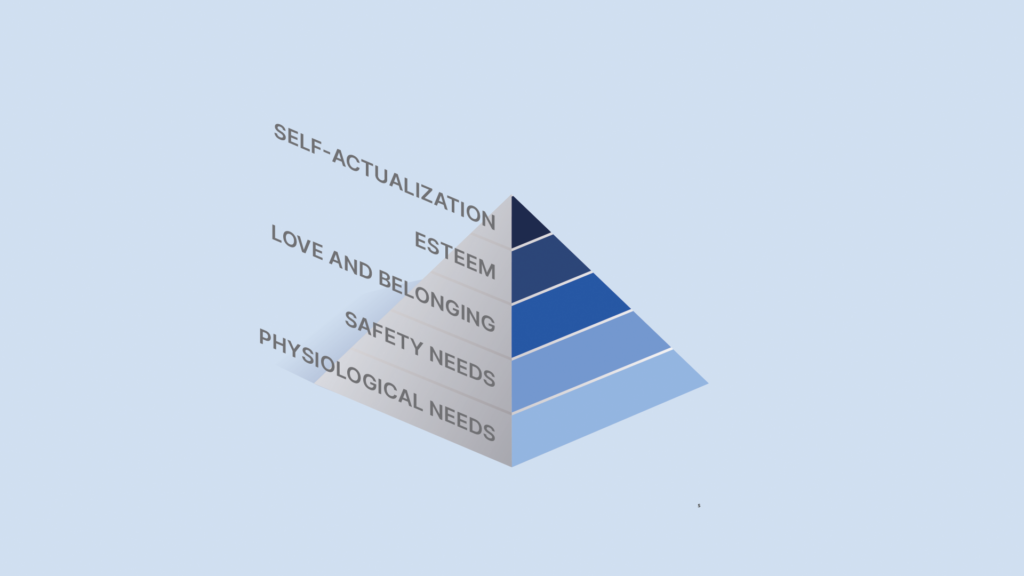

How much bitcoin should you own? Do you own enough? Too much? To answer that for yourself, I suggest you start with your end goals. Consider Maslow’s famous hierarchy of needs and imagine all the different reasons you and others could be adopting bitcoin.

When you save in bitcoin, are you looking to:

People invest and save in bitcoin for many different reasons. Keep this in mind when taking other people’s advice. They are often playing a different game than you. They have different upbringings, worldviews, family dynamics, goals, and circumstances. A 100% allocation to bitcoin may seem crazy to some people, yet perfectly reasonable to others. The same goes for having a 1% allocation. Nobody is crazy; they just have different goals. It is best to know exactly why you own bitcoin so you can match your allocation to your goals. You’ll also sometimes discover that for some purposes, maybe bitcoin is not the best tool for the job (gasp!).

As Nietzsche said, “He who has a why can bear any how.” If you know why you own bitcoin, the volatility becomes much more bearable (pun intended).

Just as important as the “why” question is the “what” question. When you allocate to bitcoin, what exactly are you saving in? Education is powerful, and seeing bitcoin from a different perspective can help you regain conviction and remain committed to a long-term view of the asset. Find bitcoin signal amidst the noise. Consume podcasts and articles that focus on education instead of short-term market speculation. If you haven’t checked out Unchained’s, Gradually, Then Suddenly series, it’s a fun dive deeper down the rabbit hole.

Talking to like-minded individuals is my highest recommendation. Bounce your ideas off of other people on the same journey. They’ll see bitcoin from a different point of view and give you feedback about your perspective. Attend local meetups, Twitter spaces, or webinars and ask questions. No honest question is a stupid question. You’ll find that, in general, bitcoiners are some of the most helpful and optimistic people out there.

Take advantage of bitcoin’s volatility by committing to a regular savings plan. Check out the typical emotional life cycle of investing through highs and lows:

By selecting a predetermined savings amount on a regular schedule, you’ll automatically buy bitcoin during every bull run and stack even more sats when it’s on sale. This consistent savings pattern dampens the emotion associated with volatility and keeps you focused on the long term. For a deeper dive into dollar-cost averaging, check out this article.

The best way to never sell bitcoin when it’s down is never to need to. Knowing that your short-term needs are covered—both expected and unexpected—can provide peace of mind to ride out the storms. And until adoption permeates, dollars will continue to serve a role in medium-of-exchange functions.

Since the recent bitcoin highs in November 2021, my family unexpectedly experienced: three visits to the emergency room, selling and buying a home, a car purchase, two career shifts, two major surgeries, and a water leak that flooded the majority of our home. We also added a much-needed vacation to take a breather after it all. Relying on bitcoin to fund these unplanned short-term expenses would have added unnecessary stress to the situation.

Sizing your emergency fund or cash buffer to handle the majority of life’s little curveballs dampens the need to sell bitcoin unexpectedly. A common rule of thumb is to keep three to six months of expenses as an emergency fund. A little bit of short-term pessimism can help sustain your long-term optimism.

Let’s jump into a quick hypothetical example. You rolled over your retirement account into an Unchained IRA when it was $60,000 per bitcoin, and you were able to purchase a whole coin for $60,000. Now, the price is roughly $20,000 per coin. You could perform a Roth conversion involving a move of some or all of that bitcoin into a Roth IRA. The upfront cost is paying the taxes associated with adding $20,000 to your income, but the payoff is that all of the future gains in the Roth will be tax-free upon qualified distribution.

Fast forward “x” number of years to retirement age, and bitcoin has worked its “number go up” magic: $500,000 per bitcoin. The Roth conversion strategy may have cost $5,000 in tax on the conversion date (assuming a flat tax rate of 25% on the $20,000 converted). Not having converted would cost $125,000 in tax in retirement. The hypothetical Roth conversion saves you $120,000.

Popping the hood on the math: the higher you expect bitcoin to grow, the higher the potential tax savings from a Roth conversion. This strategy only applies to pre-tax retirement accounts and can have substantial tax implications, so please consult your tax advisor.

If you purchased non-retirement bitcoin for more than its current value, you could sell that bitcoin for a capital loss.* At tax time, capital losses are used to offset capital gains and can also be a deduction against other income (up to $3,000 per year with unused amounts carrying over to the next tax year). In other words, if you bought bitcoin for $25,000 and sold it for $22,000, your $3,000 loss could be used as a write-off. At a 33% marginal tax rate, this would save you about $1,000 in tax. Yay!

But you’ve sold your bitcoin. Not yay : (

To maintain your long-term exposure and continue hodling, you need to buy it back. After “harvesting the loss,” repurchasing the bitcoin for $22,000 would give you a new basis (purchase price).

This strategy only applies to non-retirement accounts and can have substantial tax implications, so please consult your tax advisor.

warning: There is no firm IRS guidance on whether bitcoin sales/repurchases run afoul of a wash-sale doctrine. The statutory wash sale rule (section 1091 of the Internal Revenue Code) applies only to securities, and bitcoin is not a security. However, there is debate about this within the legal and accounting professional community. At issue is whether the same disallowance of wash-sale losses applies to bitcoin under the broader common law “substance over form” tax doctrine and its child doctrines: the “economic substance doctrine” and “step transaction doctrine”. Those common-law doctrines are not limited to securities. Some advisors are comfortable with an immediate sale and repurchase. In contrast, others recommend exposure to a “price correlated” asset (such as GBTC, Microstrategy stock, mining stocks, etc.) to wait out a 30-day wash-sale window before repurchasing bitcoin.

The essential thread of the above strategies is to focus on what you can control. Price, regulation, macroeconomic conditions, etc., are all uncontrollable factors. Empower yourself and concentrate your time and energy on what’s controllable. You have direct influence and ownership over adjusting your allocation, growing your bitcoin network, continuing your bitcoin education, committing to saving regularly, increasing your cash cushion, and evaluating your tax strategies.

Hodling bitcoin is simple, but it’s not easy. Learn to embrace volatility and dance with the bear rather than fight it.

If you’re saving bitcoin for the long term, it’s worth considering saving in an IRA, which ensures your bitcoin are tax-advantaged when you finally decide to spend or sell. Unfortunately, most bitcoin IRA providers require you to give up control of your keys. Unchained Capital offers a solution—by making it simple for you to set up a bitcoin IRA while keeping control of your bitcoin keys. Learn more by scheduling a no-strings-attached consultation with a member of Unchained’s IRA team. An expert about bitcoin IRAs will be happy to walk you through the available options and answer any of your questions.

Many of bitcoin’s staunchest critics have expressed doubt about its 21 million cap, but perhaps the most mindless criticism relates…

Ted Stevenot, Stephen HallWhen Satoshi Nakamoto created bitcoin, he established in its code a fixed number of bitcoin that will ever exist. Since…

Ted StevenotOriginally published in Parker’s dedicated Gradually, Then Suddenly publication. Bitcoin is often described as a hedge, or more specifically, a…

Parker Lewis