How does the bitcoin source code define its 21 million cap?

Many of bitcoin’s staunchest critics have expressed doubt about its 21 million cap, but perhaps the most mindless criticism relates…

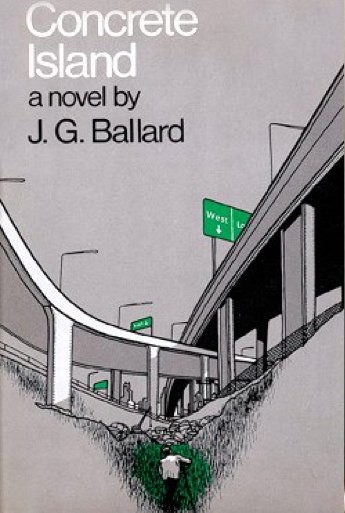

,JG Ballard’s novel Concrete Island, published in 1974, presented one of the most vivid dystopian scenarios in modern fiction, more compelling because its premise had basically already arrived: A motorist loses control of his car on a freeway outside of London and crashes into a derelict patch of land boxed in by the surrounding roadway infrastructure, where he becomes stranded. As the traffic never relents and the median’s design has never needed to account for a human presence, the protagonist can’t cross to safety despite being feet away from it, marooned in the heart of a major world city amid a constant flow of would-be helpers who are speeding by too quickly to notice him.

Ballard’s scenario illuminates a landscape that has become increasingly striated and rigid, one in which centralized force runs roughshod over local territory and individual circumstance. Although the story precedes the advent of blockchain technology by decades, Concrete Island offers a visceral critique of the restrictive complacency of late capitalism, affirming the need to distribute certain kinds of agency among the wider constituency from whom it has receded. If information, by now, is as much a currency as physical space, then the ledger is a form of infrastructure as important as the road, and the blockchain’s ability to chart escape routes across similarly heavy and entrenched boundaries demonstrates a real, emergent value.

Ballard’s scenario illuminates a landscape that has become increasingly striated and rigid, one in which centralized force runs roughshod over local territory and individual circumstance. Although the story precedes the advent of blockchain technology by decades, Concrete Island offers a visceral critique of the restrictive complacency of late capitalism, affirming the need to distribute certain kinds of agency among the wider constituency from whom it has receded. If information, by now, is as much a currency as physical space, then the ledger is a form of infrastructure as important as the road, and the blockchain’s ability to chart escape routes across similarly heavy and entrenched boundaries demonstrates a real, emergent value.

Following his crash into the embankment, Ballard’s protagonist learns that the freeway, which enables such high speeds of travel, imposes barriers that divide urban space in an absolute and even violent manner. The imperative of motorized speed and the sprawling infrastructural system that facilitates that speed rule out familiar alternatives like walking, even under ordinary conditions, a phenomenon the philosopher Ivan Illich called radical monopoly:

“Cars create distance. Speedy vehicles of all kinds render space scarce. They drive wedges of highways into populated areas, and then extort tolls on the bridge over the remoteness between people that was manufactured for their sake. This monopoly over land turns space into car fodder.”

Today, radical monopoly has assumed its most recognizable forms in the digital sphere. It’s not hard to imagine a near-future version of Concrete Island in which a platform like Amazon or Facebook arbitrarily cuts someone off from a society that surrounds them, like Ballard’s motorist. Apple just announced that it will begin using a Chinese data center to host its users’ cryptographic iCloud keys, exposing that previously protected data to the Chinese government’s scrutiny and endangering the affected users within the country — a Ballardian example of a worst-case scenario for arbitrary, centralized encryption. Alternatively, imagine a suburban town outlawing private vehicles and replacing its bus system with Google-operated self-driving cars before an algorithmic tweak de-prioritizes a certain user, isolating him miles from any amenities and forcing a dangerous foot journey across the sprawlscape. The dominance of such platform megastructures in physical and digital space creates an ongoing imperative to design tools and institutions that counteract their centralizing tendencies, returning agency to individuals and poking holes in the overly rigid barriers that have divided that space.

The blockchain has emerged as one such mechanism for counteracting radical monopoly at this nexus of code and control. Its potential reaches so broadly and addresses these concerns so directly that it has assumed a utopian role among its adherents. Today, many of our most powerful new technologies, such as artificial intelligence, are built and used in ways that support the status quo of centralization and consolidation. Blockchain promises to do the opposite (Peter Thiel said that “Crypto is libertarian, AI is communist”). The particulars of blockchain’s continuing implementation, however, must ensure that promise is realized. Even within the blockchain ecosystem, for example, centralizing forces have already emerged in the form of platforms such as Coinbase.

Like the “slower” alternatives to freeway and air travel that Illich praised, blockchain applications are often inferior to their radical monopoly equivalents by certain measures of performance, at least today. “On almost every dimension,” Taylor Pearson writes, “Bitcoin is worse than its centralized counterparts like PayPal or Chase.” Riding a bike, similarly, is slower than driving at 70 miles per hour, and harder work, but we can sense that cycling is an ingredient of a more convivial society, one in which individuals and communities have more control of their environments and are less confined by conditions dictated from above. For Bitcoin, like riding a bike, “worse is better,” as Gwern Branwen observes: Both just work. Bitcoin, despite its flaws, enables reliable peer-to-peer transactions that don’t require bank validation and aren’t restricted by the usual gatekeepers (even if Bitcoin isn’t the best way to buy a cup of coffee). As blockchain technology evolves, it will likely begin to catch up with its centralized alternatives, even in dimensions where it underperforms today, and sometimes in unexpected ways (by now, riding a bike through Manhattan is frequently faster than the equivalent car trip). Or, as Chris Dixon recently argued,

“Cryptonetworks combine the best features of the first two internet eras: community-governed, decentralized networks with capabilities that will eventually exceed those of the most advanced centralized services.”

Blockchain technology and its most visible application, cryptocurrency, have presented this version of utopia to a world that spent much of the last century living down the harmful legacies of another kind of utopian thinking, modernism, and in many ways is still facing that movement’s negative effects. Concrete Island and Illich’s writing both grappled with modernism’s fallout in the 1970s, which at the time was largely felt in cities and the built environment. Today, many of those problems have resurfaced in digital space, as discussed above: Increasingly dominant platforms have divided up the internet and now exercise a control over their territory that is anything but democratic, relying heavily upon arbitrary censorship, restrictive access, and opaque algorithmic architecture. Nation states still don’t behave much better, either. As the automobile eventually recoded so much urban space as “car fodder,” these entities have led a similar transformation of information space, one that turns networks and markets into fodder for their own objectives. Blockchain’s utopian vision remains far from realization, but today, cryptocurrencies already solve some of the problems these megaplatforms create, offering an appealing haven from digital and financial centralization.

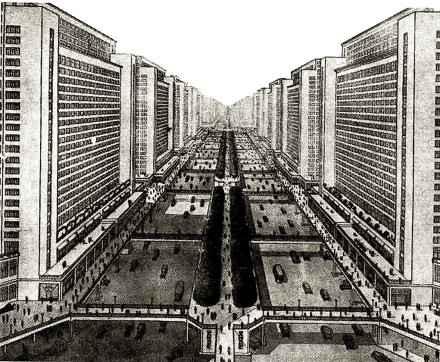

One of modernism’s pillars, legibility, is a useful lens through which we can view cryptocurrency and blockchain: In Seeing Like a State, James C. Scott documents the relationship between legibility and centralized power: forcing illegible groups and their environments to become more legible is a means of monitoring those groups’ activity and thus controlling them. Architectural modernism was a philosophy of legibility, seeking to impose its elegant, simplified forms upon the rich, intricate, and well-balanced urban fabric that had evolved before it. That quality was one reason governments embraced modernism. Now, of course, Facebook and Google are the most potent legibility engines imaginable, capturing data about their users with unprecedented fidelity and converting that data into algorithmic engagement and ultimately advertising revenue. Steve Jobs and Jony Ive have openly acknowledged modernism’s influence on Apple’s product designs, and its underlying philosophy echoes the problematic centralization of Apple’s user data.

Blockchain, at different levels, is a source of both illegibility and legibility. At the network level, it tends toward illegibility, with encryption keys distributed among individuals. At more granular levels, ideally, blockchain might create the minimum viable legibility for transactions in murky or complicated domains where they previously wouldn’t have been possible — among smaller parties and individuals dealing with one another outside the scope of Coasean organizations (as this kind of legibility lowers peer-to-peer transaction costs, that key function of traditional firms will diminish). For those centralized organizations, again, blockchain is less legible than the data sources and networks they own and control, hence the blockchain’s association with anonymity and censorship avoidance. More than the blockchain creates or destroys legibility, then, it transfers that legibility from its typical wellsprings — proprietary databases and business processes — to the peripheral sites of peer-to-peer transaction that have long engaged with legibility primarily on the centralized institutions’ terms. There is creeping evidence, meanwhile, of a desire to impose greater legibility on cryptocurrencies at the network level, a tendency Pearson compares to the ill-fated modernist effort to design legible cities like Brasilia.

1/ If crypto networks are like cities, then there is an interesting argument that we are building a lot of Brasilias right now. https://t.co/rs2L9Ovd8W

— Taylor Pearson (@TaylorPearsonMe) February 20, 2018

JP May observed that we are entering the age of the “sovereign individual,” in which individuals will increasingly fulfill roles that corporations and governments previously did, creating demand for “harder” money that resembles cash more than credit. The internet has organized those individuals into what Balaji Srinivasan calls “cloud formations,” groupings that form via digital interaction but remain (or become) grounded in the physical world, such as Meetup groups, message board communities, and even dating app users. As these cloud formations keep maturing, they will increasingly bypass incumbent institutions and intensify the need for currencies that are decentralized as well as “hard.” As this process delocalizes human cooperation, Srinivasan writes, the infrastructure that supports it will follow suit. If blockchain thus enables informal communities and ad hoc groups to “see like a state” in their own modest spheres, then the consequences of that transition aren’t yet clear.

This blockchain-enabled fragmentation of legibility evokes another famous work of anti-modernist urbanism, Collage City, by Colin Rowe and Fred Koetter. They write,

“The open society depends upon the complexity of its parts, upon competing group-centered interests which need not be logical but which, collectively, may not only check each other but may, sometimes, also serve as a protective membrane between the individual and the form of collective authority.”

The blockchain utopia assumes a similar form, as a pluralistic ecosystem in which a multitude of “sovereign individuals” and smaller-scale groups carve out their own enclaves within the territory that governments, big banks, multinational corporations seek to consolidate within their own control today. In this future the Organization Man, a creature of those large institutions, gives way to the Blockchain Man, who thrives in the balkanized landscape of forked authority that follows. Of course, this is only the idealized scenario: The blockchain ecosystem could yet prove as vulnerable to centralization as its predecessors, despite the mechanics of the underlying technology — a fate that appears to have befallen the internet itself in its recent evolution. The hardware requirements of cryptocurrency mining, for example, might lead to the consolidation of mining capacity by highly-capitalized corporate entities similar to those that gradually amassed control of the Web.

Given blockchain’s potential to transform society’s underlying structure, then, what does that imply for cities themselves? The internet’s impact on the urban environment, still unfolding, has touched that environment’s every facet, from the role of physical retail to the process of hailing a taxi to simply navigating unfamiliar streets. Will blockchain have comparable effects? Bruce Sterling recently described one nascent scenario, distinctly different from the “smart city” narrative that seemed so likely until recently: “What future cities have in store, I surmise, is not a comprehensive, sleek, point-and-click new digital urban order, but many localized, haphazard mash-ups of digital tips, tricks, and hacks.” Sounds illegible, doesn’t it? Sterling argues that the rationalized, optimized city that operates like a machine, centrally coordinated by an IBM or a Cisco, has little to do with the reality that has already arrived, one in which the centralized powers that do influence cities embrace surveillance marketing and “data extractivity.” From Facebook to the sovereign individual, it’s enclaves and walled gardens all the way down. Although Sterling doesn’t mention blockchain, that technology resonates as a key source of the localized, decentralized agency that might help deliver us from both the ossified smart city and looming megaplatform surveillance.

This blockchain utopia, if it arrives, will rewire cities as the internet did, starting with the most fundamental reasons for cities’ existence: commerce, transactions, and information exchange. When these activities change, history has shown, the city’s physical form will follow. So far, the blockchain’s impact on human settlements has been superficial: The financial returns on cryptocurrency mining have driven a reallocation of server capacity, encouraging migration to the optimal sites for that mining. An uneven regulatory landscape for cryptocurrency has influenced additional migration. Others have begun suggesting localized tokens as an experimental method of allocating public services in cities like New York, while Venezuela has announced its own oil-backed cryptocurrency, the petro, to circumvent its economic problems.

As a metaphor, though, the blockchain frames a future that is better than our current trajectory, a more optimistic version of Sterling’s cyberpunk dystopia, and these metaphors matter: After the modernist architect Le Corbusierproclaimed in 1927 that the house is a “machine for living in,” our buildings and cities spent the rest of the century growing into that vision, with humans thrown in among the gears of those machines (a truth that J.G. Ballard dramatically illustrated in his fiction fifty years later). Le Corbusier believed that architects and urban planners had failed to articulate the specific problems that engineers were solving so well (“The airplane shows us that a problem well-stated finds a solution”). The result was an overcorrection toward narrow functionalism in buildings and cities, at the expense of pluralistic environments that respond imperfectly to a much broader array of human problems — environments in which “worse is better.” In order to dismantle the still-prevalent belief that people want to inhabit centrally-operated machines, in physical or digital space, we need an equally powerful idea to replace that belief. Blockchain, in its ideal course of evolution, might actually accomplish that goal.

The Long Hold is a series of essays and opinion pieces from the Unchained Capital team and greater community speculating on the nature and future of bitcoin and blockchain systems.

To learn more about Unchained Capital and our bitcoin-secured loans, sign-up on our website. To stay up to date on Unchained Capital news and announcements, follow us on our Blog and Twitter.

Many of bitcoin’s staunchest critics have expressed doubt about its 21 million cap, but perhaps the most mindless criticism relates…

Ted Stevenot, Stephen HallWhen Satoshi Nakamoto created bitcoin, he established in its code a fixed number of bitcoin that will ever exist. Since…

Ted StevenotOriginally published in Parker’s dedicated Gradually, Then Suddenly publication. Bitcoin is often described as a hedge, or more specifically, a…

Parker Lewis