How does the bitcoin source code define its 21 million cap?

Many of bitcoin’s staunchest critics have expressed doubt about its 21 million cap, but perhaps the most mindless criticism relates…

,

If you’ve ever felt a bit uneasy during the process of sending or receiving bitcoin, you’re not alone. Many people feel apprehensive when it comes to moving bitcoin around.

After all, navigating self-custody within a decentralized system means there’s no third party responsible for facilitating your transactions. If you’re careless and send bitcoin in error, there’s no one else to blame, and no one who can reverse the action. This stands in stark contrast with the traditional banking and credit card system, and it’s a tradeoff associated with unchaining yourself from these institutions—with great power comes great responsibility.

On the other hand, it’s also common for people to feel anxious about their bitcoin transaction in instances where they don’t need to be. For example, you might follow all the correct procedures, but then feel some uncertainty about the transaction successfully “going through.” Or if a transaction has been broadcast and is currently pending, you might find yourself hoping that the bitcoin doesn’t “get lost along the way.”

Concerns like these stem from an inaccurate perception of how bitcoin transactions work. In this article, we’ll provide a framework for better understanding the mechanics of bitcoin transactions, to help you feel more comfortable and confident about what’s actually happening behind the scenes.

Any time you’re learning a new concept, it’s tempting to use comparisons with other things you’re already familiar with. Analogies can be useful for introductory education, but they’re never perfect. Getting too caught up in an analogy can cause you to make incorrect presumptions, which is often the case with bitcoin.

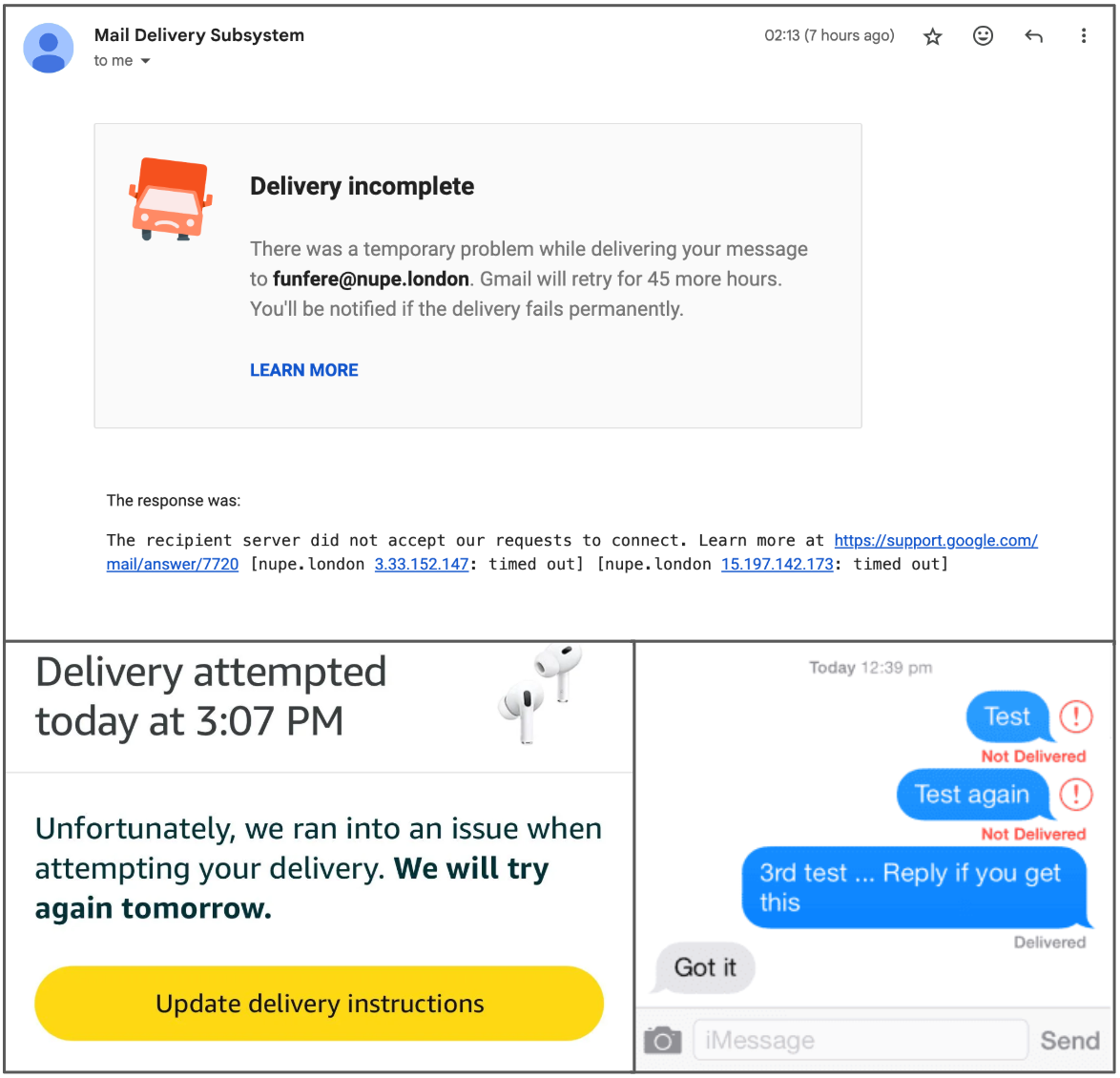

In our earlier article about bitcoin addresses, we used some analogies to explain them, suggesting that they could be compared to email addresses or physical mailing addresses. However, that comparison only goes so far. It can lead to the incorrect perception that quantities of bitcoin are “in transit” before eventually “being delivered” to a bitcoin address. After all, this is what happens with physical mail, or data being sent in text message or email—and all of these suffer from the possibility of an unsuccessful delivery.

Examples of delivery failures are prominent in both the physical and digital world.

Fortunately, this type of “unsuccessful delivery” isn’t a concern for bitcoin, because contrary to popular belief, bitcoin never really moves from one place to another! Bitcoin doesn’t travel through wires, nor is there any person, program, or entity responsible for carrying bitcoin from Point A to Point B. Bitcoin is never in transit, and it never exists somewhere between the sender and receiver. Even the words “send” and “receive” are analogies that fail to provide an accurate representation of what’s occurring during a bitcoin transaction.

Instead, the correct framing is that updated knowledge of who bitcoin belongs to is spread globally. If you pay someone in bitcoin, a better analogy is that you are making a public announcement. You are verifying yourself as the owner of some bitcoin by using your private keys, and declaring to the world that a portion of that bitcoin no longer belongs to you, it belongs to the person you are paying. This knowledge is irreversibly spread, until the entire network is aware, at which point the payment is complete. Let’s take a closer look at how this works.

As we covered in an earlier article, bitcoin wallets don’t actually hold bitcoin. A bitcoin “wallet” is yet another imperfect analogy. While it may help people conceptualize where they can view their bitcoin balance and how to keep it protected, the term is also a common source of confusion regarding where bitcoin is really stored.

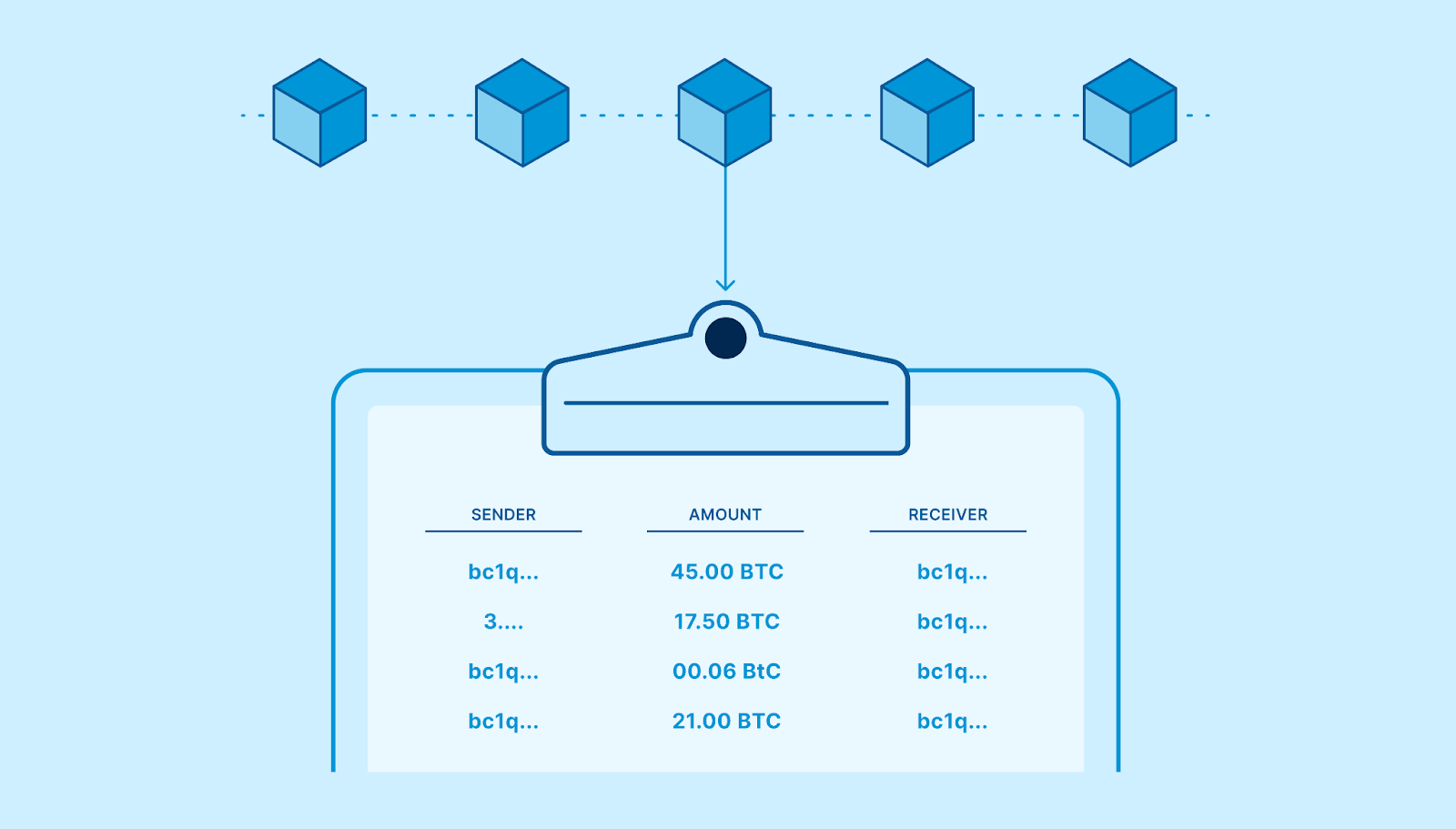

Everybody’s bitcoin (eventually, all 21 million) exists in the same place—the bitcoin blockchain. The blockchain is a ledger, or digital record book, keeping track of all the bitcoin transactions and how the supply is divided among various addresses. The blockchain has copies existing in many different physical locations, wherever someone runs a bitcoin node. If you run a node yourself, you can have a copy of the entire blockchain stored in your home! No single node is the definitive source of truth, which is why the bitcoin network is described as decentralized or distributed.

When a transaction occurs, the blockchain ledger must be adjusted to reflect the updated balances, across all of the nodes worldwide. This is what happens when a new block is added to the blockchain, approximately once every ten minutes. Each new block contains updated information about the bitcoin values attributed to various addresses. Nodes validate that the new blocks are following all of the rules, and then help spread the new block information to other nodes plugged into the network.

A block on the blockchain adds new transactions to the ledger, thereby reallocating bitcoin away from some addresses and towards others.

If you want to make a payment in bitcoin using the traditional method, you must work through the following steps:

In summary, you create a transaction and announce it publicly. Then, a decentralized and trust-minimized network of nodes and miners serve as intermediaries, validating your announcement and spreading knowledge of it until the recipient is reasonably satisfied. Despite the bitcoin whitepaper referencing a “peer-to-peer electronic cash system,” this title is another imperfect and colloquial description of how bitcoin truly functions.

This transaction model explains why you can receive bitcoin payments while being completely offline. As long as you’ve shared an address that belongs to you, other people can subsequently broadcast transactions to the network which are paying bitcoin to that address. Only the sender needs to be momentarily connected to an online node to facilitate the broadcast, or the “payment announcement.” The bitcoin network automatically takes care of the rest. Once the transaction has been confirmed by being added to the blockchain, the bitcoin is officially attributed to your address and under the control of your keys. Whenever you come back online by connecting to a node, you will be able to see your updated balance.

If a transaction is pending, that means it has been broadcast but not yet confirmed to the blockchain. Transactions are usually pending for less than an hour, if a recommended fee rate corresponding to the current fee market was chosen by the sender (which is the default option for most wallet software).

However, the fee market could experience a sudden increase in fee rates at any time, due to an influx of global demand to move bitcoin quickly—often when the bitcoin price becomes particularly volatile. If you author and broadcast a transaction at a lower fee rate before such a spike, miners won’t be focused on including your transaction in the next block. They will earn more fees by choosing the newer transactions paying higher fee rates. Instead of being near the front of the queue, your transaction could be much farther back in line. In some cases, it could be “stuck” for hours, days, weeks, or even months before fee rates fall back down to match the bid from your transaction, and it is finally mined into a block.

Scenarios like this have been known to cause anxiety among transaction participants. Neither the sender nor the receiver might feel like the bitcoin is in their possession. So where is the bitcoin? Could it be lost or vulnerable? To answer these questions, we must remember that the blockchain is the source of truth. Since the transaction hasn’t been added to the blockchain yet, the payment hasn’t been settled. The bitcoin technically remains in the possession of the sender, until the blockchain is finally updated to credit the bitcoin to the recipient.

Once a transaction has been broadcast, it’s impossible to “un-broadcast” or cancel it. By default, the bitcoin will eventually transition to the recipient’s address, unless further action is taken. There are a few things that can be done:

With these methods, it’s always possible to speed up a stuck transaction, for a price. If multiple fee bumping techniques are deployed simultaneously, miners are incentivized to choose the combination that pays them the most fees, and disregard any contradicting transactions.

So far, we’ve covered information pertaining to the original and most fundamental method of conducting transactions: utilizing the blockchain directly. However, some have found other ways to transfer bitcoin ownership outside of the blockchain.

This might seem impossible at first, given that all of the bitcoin supply exists on the blockchain and can’t be removed from it. If an amount of bitcoin exists at an address on the blockchain, in order to be moved to another address, the blockchain must be updated. But these other methods of payment manage to keep the bitcoin at the same address, and merely adjust who the bitcoin belongs to or who can access it. Here are some examples:

In summary, you shouldn’t worry about bitcoin getting lost simply because the transaction is taking a while to be processed. As long as you double-check that your transactions contain correct information relating to the amount and destinations, practically everything else will be handled by the bitcoin network. There are also ways for either the sender or receiver to speed up the transaction being added to the blockchain, or use a different payment method outside of the blockchain.

If you want a helping hand with transactions into or out of secure self-custody, you can sign up for Unchained Signature. After receiving help with setting up a collaborative multisig vault, you’ll unlock access to year-round support from a dedicated bitcoin custody expert, ongoing education and security reviews.

Many of bitcoin’s staunchest critics have expressed doubt about its 21 million cap, but perhaps the most mindless criticism relates…

Ted Stevenot, Stephen HallWhen Satoshi Nakamoto created bitcoin, he established in its code a fixed number of bitcoin that will ever exist. Since…

Ted StevenotOriginally published in Parker’s dedicated Gradually, Then Suddenly publication. Bitcoin is often described as a hedge, or more specifically, a…

Parker Lewis