How does the bitcoin source code define its 21 million cap?

Many of bitcoin’s staunchest critics have expressed doubt about its 21 million cap, but perhaps the most mindless criticism relates…

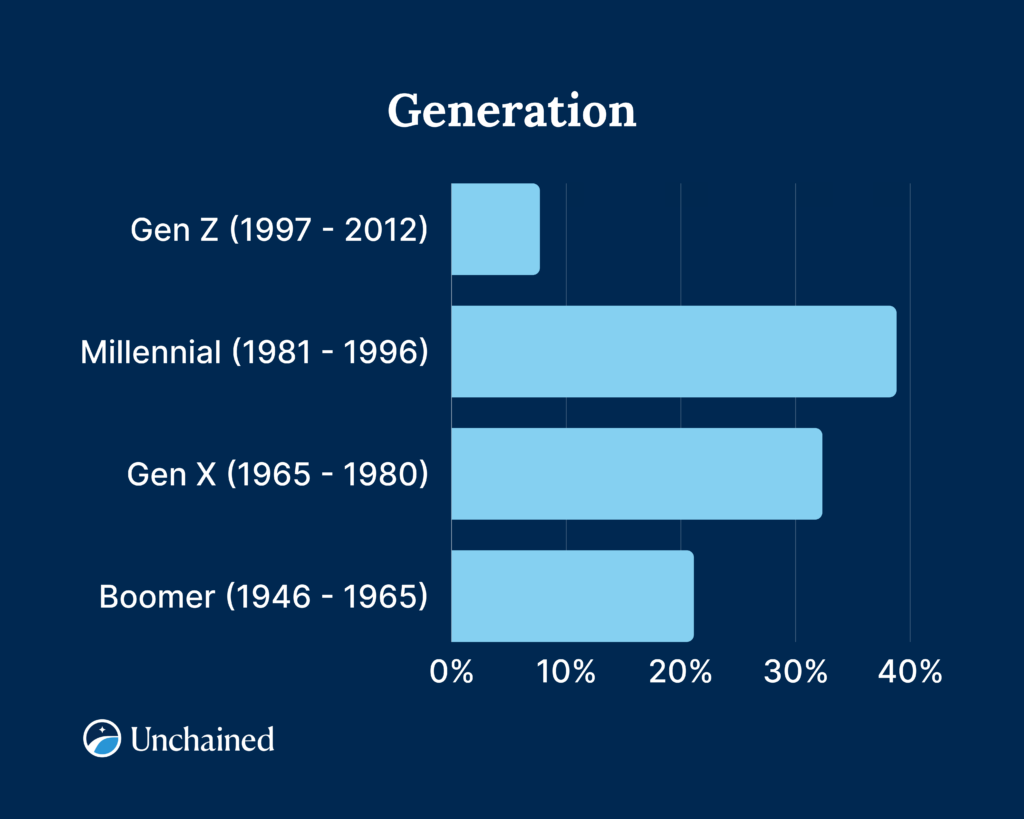

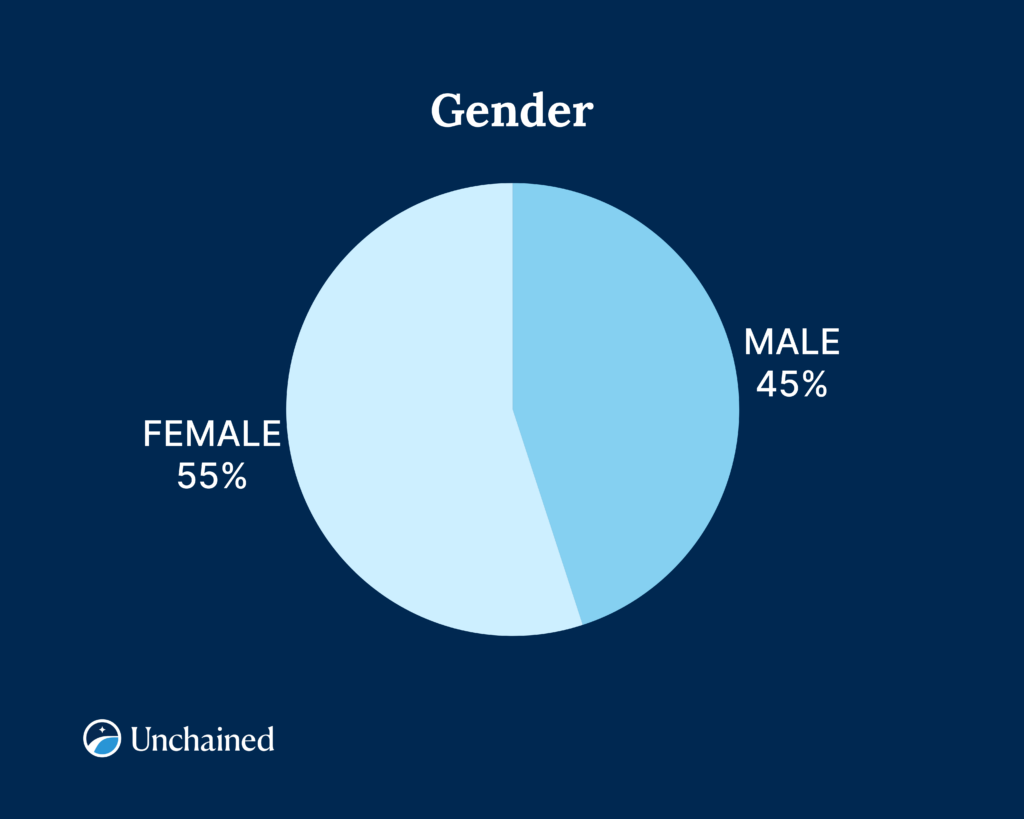

,Unchained surveyed over 400 investors across the US to learn about their current bitcoin positions and outlook for the asset. To qualify, respondents had to be between the ages of 18 and 78 years old and have at least one investment account. Here’s what we found.

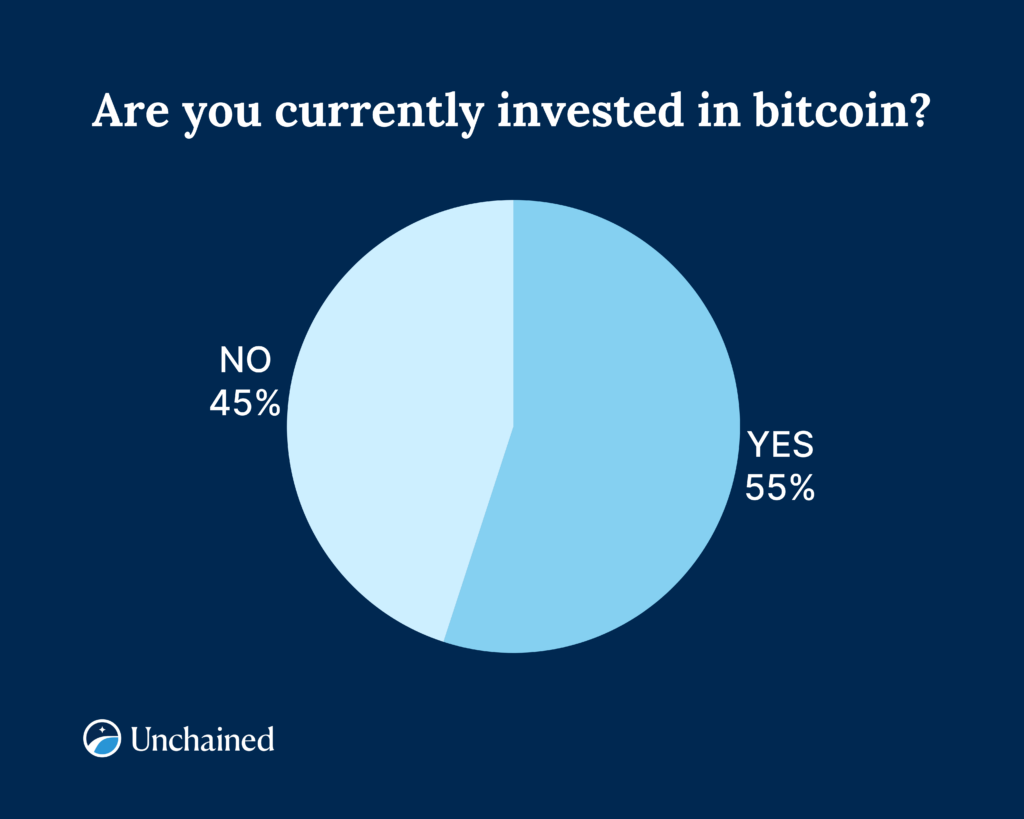

55% of surveyed people who self identified as investors report owning bitcoin.

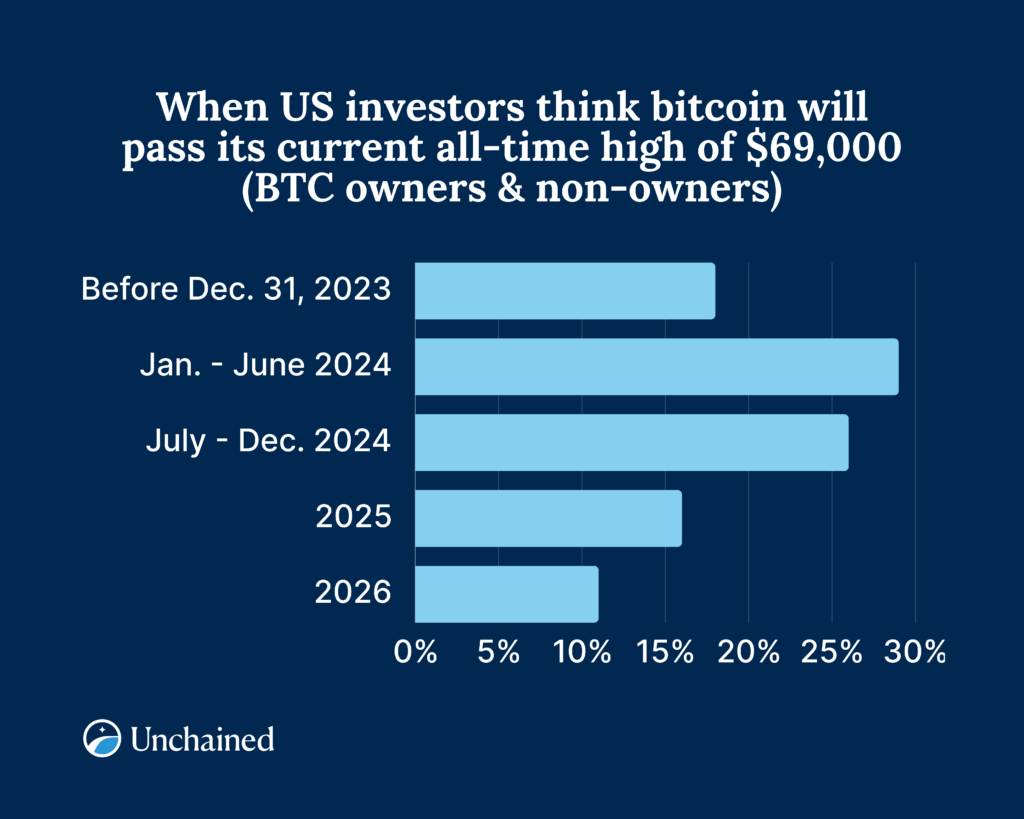

79% believe BTC will pass $69K and hit a new all-time high at some point. Among this group, 55% think it’ll happen in 2024.

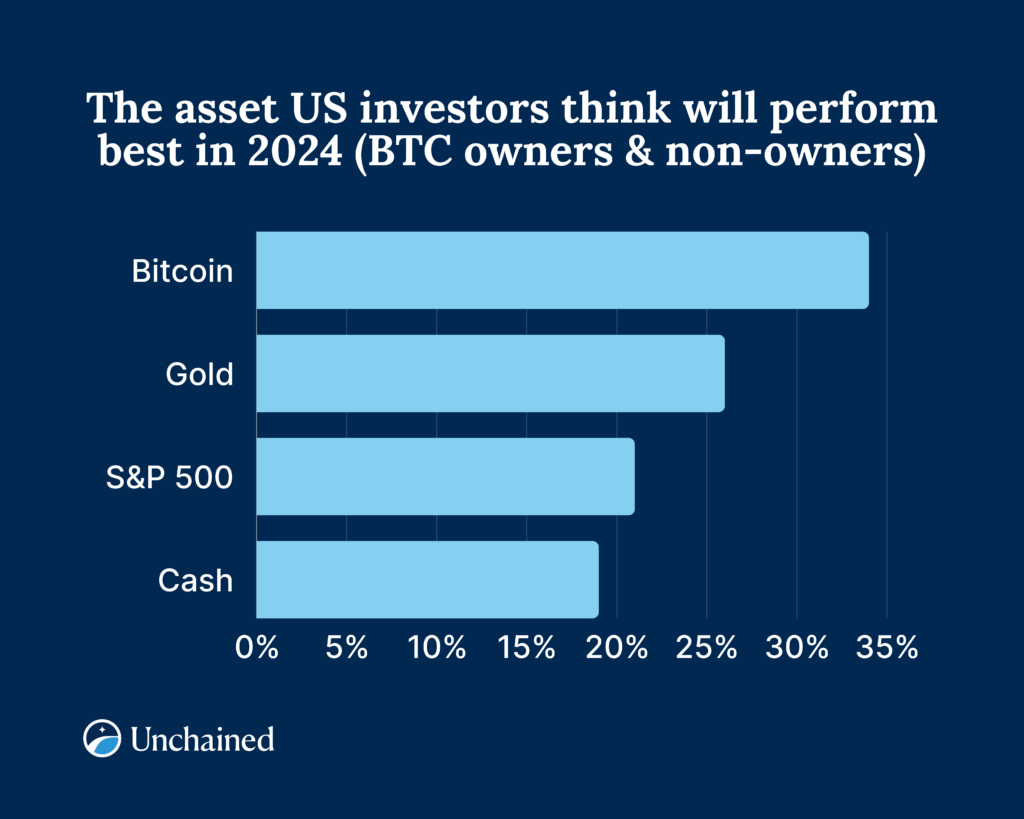

34% think bitcoin will be the best performing asset in 2024 when compared to gold, the S&P 500, and cash.

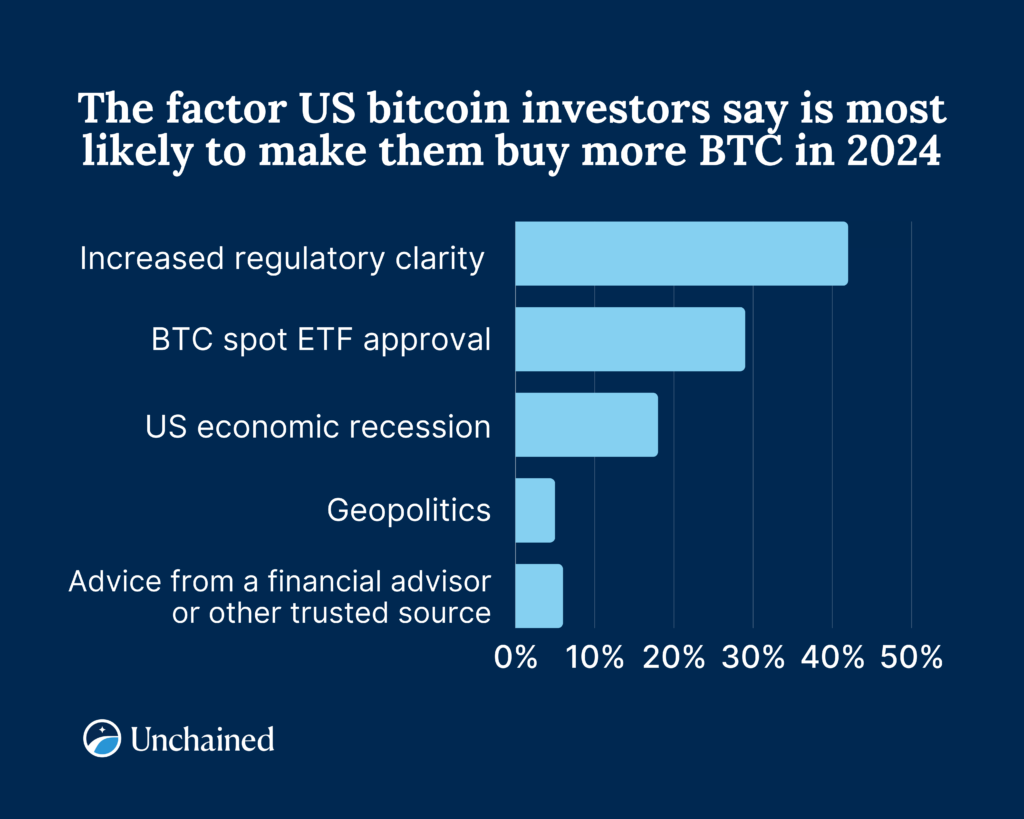

Among the 55% of BTC-holding participants, 42% say that increased regulatory clarity around digital assets is the factor that’s most likely to make them buy more bitcoin, while 29% say it’s SEC approval of a bitcoin spot ETF and 18% say it’s a US economic recession.

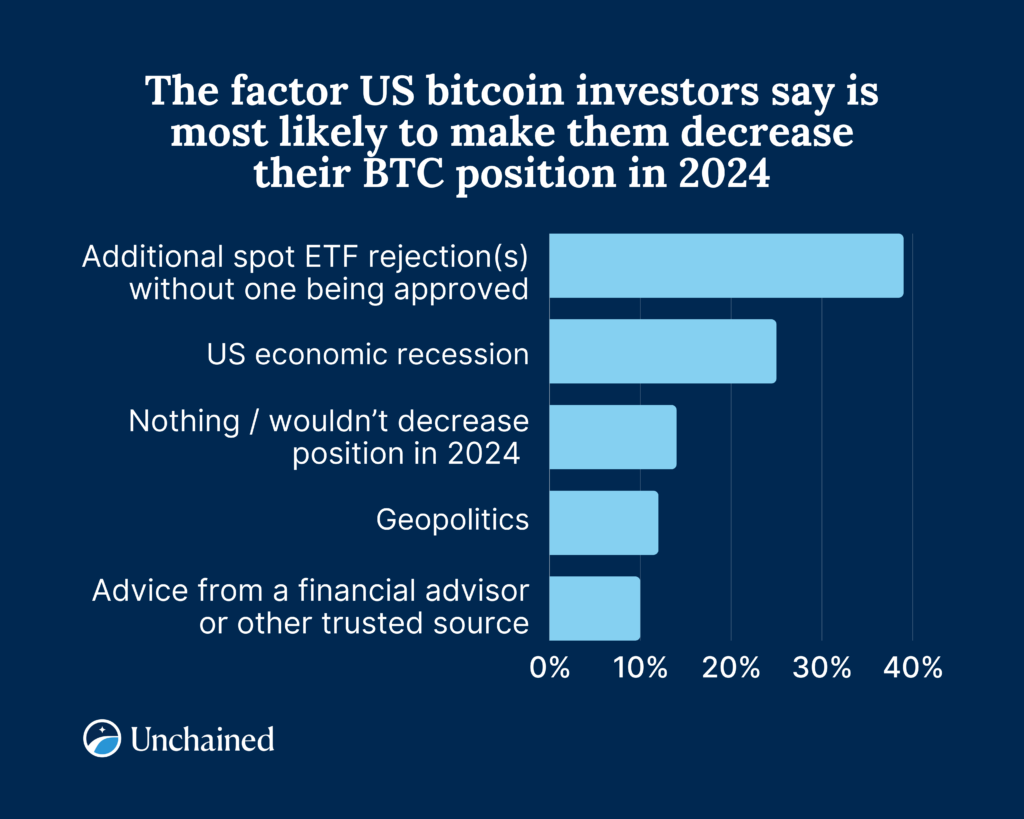

On the flip side, 39% of US bitcoin investors say additional rejection(s) by the SEC of a bitcoin spot ETF without one being approved is the factor that’s most likely to make them decrease their BTC positions in 2024. 25% say a US economic recession is the factor most likely to make them sell BTC.

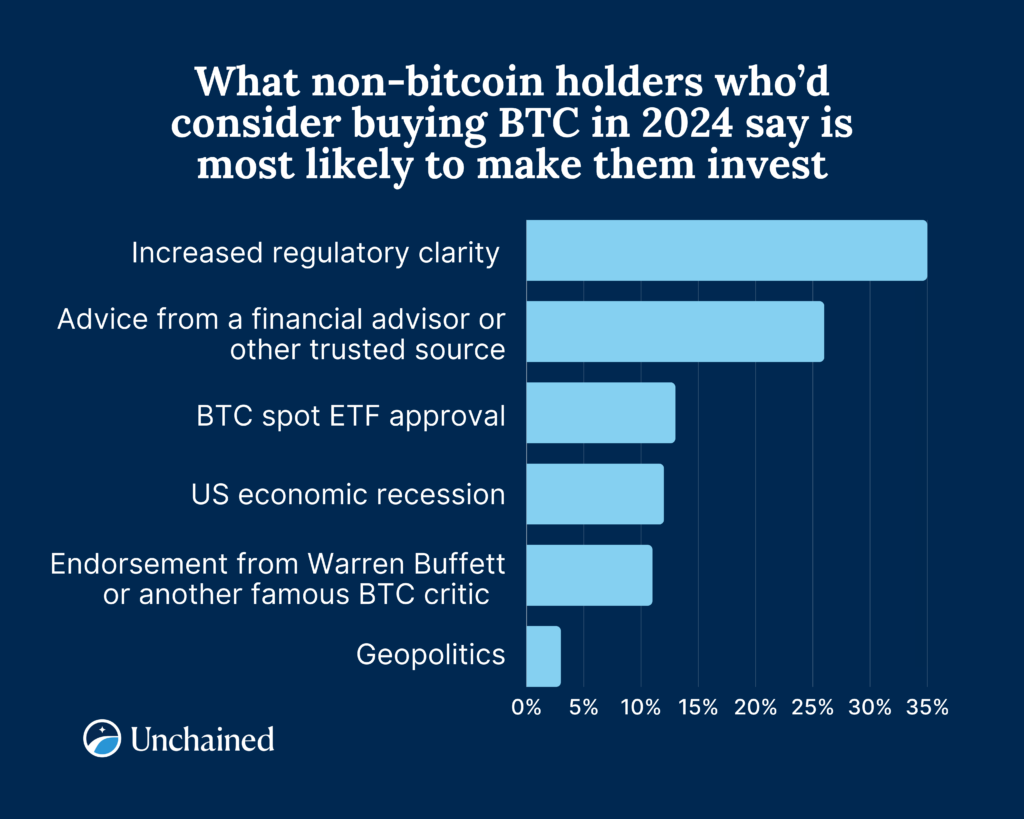

Like US bitcoin holders, regulation is important to those not yet invested: 35% say increased regulatory clarity around bitcoin/cryptocurrency is the factor most likely to make them buy bitcoin. Spot ETF approval and the US economy are less popular buying factors for prospective bitcoin investors.

Interestingly, 26% of non-bitcoin-holders say their financial advisor or another trusted source telling them to buy bitcoin is the factor most likely to make them do so in 2024.

Meanwhile, only 6% of US bitcoin holders say guidance from their financial advisor is the factor most likely to make them increase their BTC position in 2024.

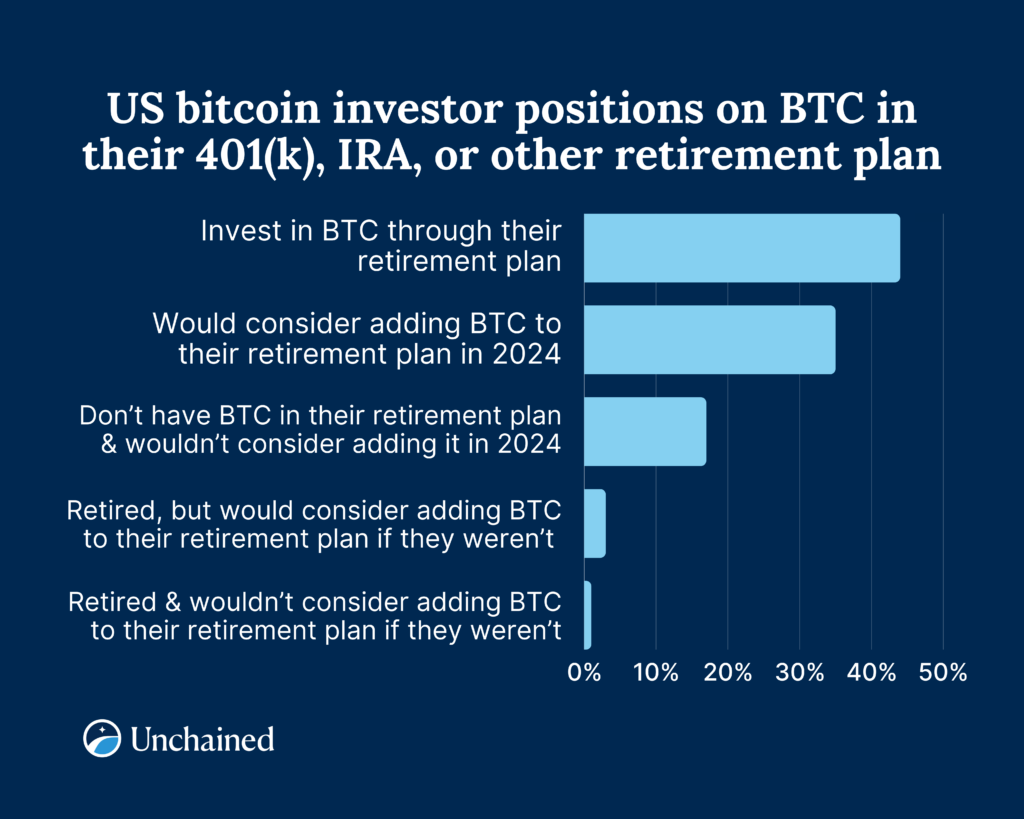

79% of US bitcoin holders say they either invest in BTC via their retirement account (401(k), IRA, or other) or would consider doing so in 2024.

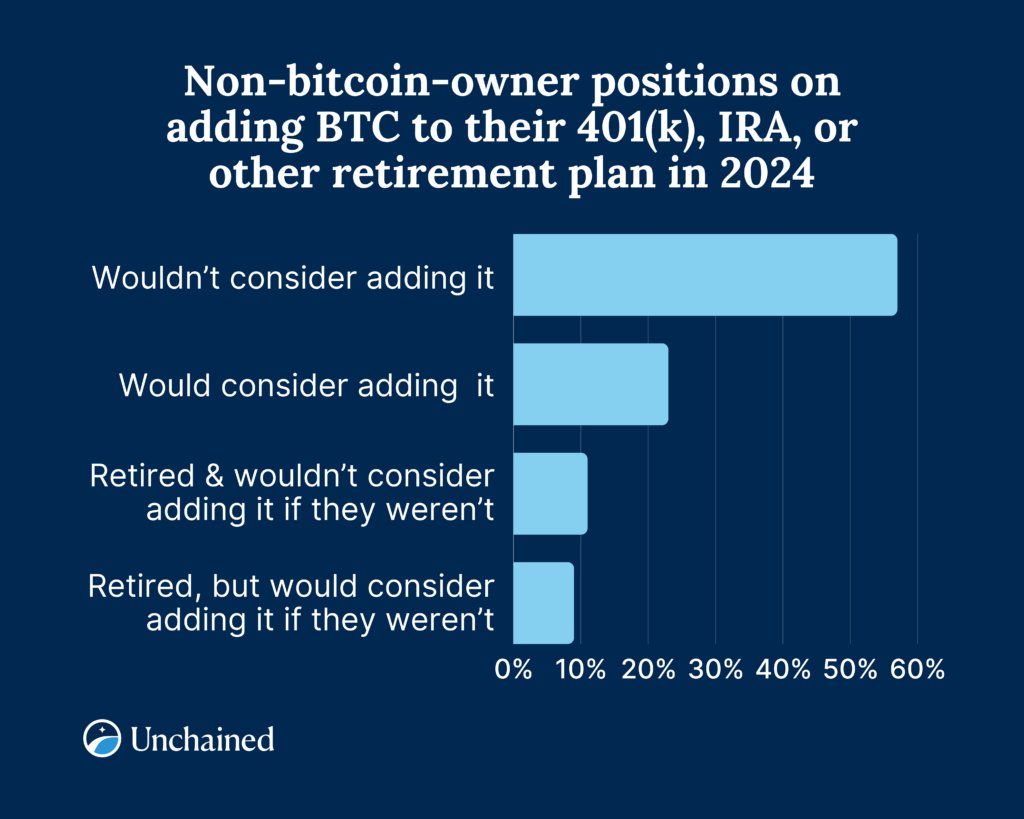

The prospect of holding bitcoin in a retirement account might broaden the market next year, with 23% of US investors who don’t own bitcoin saying they would consider investing in BTC via their 401(k), IRA, or other retirement plan in 2024.

An additional 9% of non-bitcoin-holders who are retired said they would consider adding BTC to their retirement account if they weren’t.

With an estimated 158 million Americans owning some type of investment account1, Unchained’s “US Investor Outlook for BTC in 2024” survey sample size of 402 individuals is representative of the US investor population with a 5% margin of error at a 95% confidence level. To qualify for this survey, respondents were required to be permanent residents of the US between the ages of 18 and 78 and self-report as having one or more current financial investment(s). The survey was conducted digitally from October 26 to 28, 2023, during which time the price of bitcoin ranged from $33,610 to $34,977.

1. FINRA Investor Education Foundation, “Financial Capability in the United States: Highlights from the FINRA Foundation National Financial Capability Study” (2022)

2. CoinGecko

These survey results do not represent the opinions or advice of Unchained Capital, Inc. or its affiliates (collectively “Unchained”), any employees of Unchained, or of any qualified investment advisor. Survey respondents were not qualified investment advisors. No representations are made that any survey methods are accurate or correspond with relevant industry practice. Do not make financial decisions based upon the results of this survey, instead consult with a qualified investment advisor of your choice.

Many of bitcoin’s staunchest critics have expressed doubt about its 21 million cap, but perhaps the most mindless criticism relates…

Ted Stevenot, Stephen HallWhen Satoshi Nakamoto created bitcoin, he established in its code a fixed number of bitcoin that will ever exist. Since…

Ted StevenotOriginally published in Parker’s dedicated Gradually, Then Suddenly publication. Bitcoin is often described as a hedge, or more specifically, a…

Parker Lewis