How does the bitcoin source code define its 21 million cap?

Many of bitcoin’s staunchest critics have expressed doubt about its 21 million cap, but perhaps the most mindless criticism relates…

,While bitcoin’s usefulness as a store of value and medium of exchange is becoming more widely appreciated, those choosing to adopt it tend to cluster into stages.

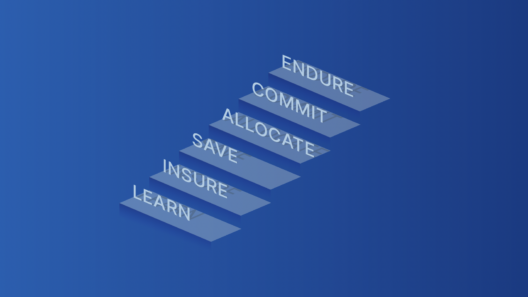

While bitcoin’s usefulness as a store of value and medium of exchange is becoming more widely appreciated, those choosing to adopt it tend to cluster into stages. These stages include learning about bitcoin, insuring against potential risks, saving for the future, allocating assets in a portfolio, committing to it as a long-term opportunity, and enduring in a permanent relationship with it.

These stages are not a predestined journey; indeed, you likely won’t make a clean progression from the first to the last. They’re also not all-encompassing; there are ways to think about bitcoin beyond these neat little boxes. But whether you’re new to bitcoin or an experienced owner, understanding these general stages can help you better align your personal goals with your bitcoin position.

“The time you first buy bitcoin, your understanding of bitcoin is necessarily limited… part of the understanding is experiencing it over time.”

– Parker Lewis

It is impossible to understand bitcoin without experiencing it. If you’re curious, the best way to learn is to jump in, and this is often the first stage in just about anyone’s personal adoption track.

There’s no minimum amount of money needed to buy bitcoin. You might want to start with an amount that would make you happy if you found it walking down the street, but sad if you lost it. For me, $20 worked just fine. The main point is to get off zero and get your feet wet. The absolute worst that can happen is you lose all of this small amount.

Play around with it and have fun. Listen to podcasts and watch webinars. Follow individuals that are taking the asset seriously. As you learn and experience bitcoin, you might gain the confidence to buy more.

“Bitcoin is insurance.” – Greg Foss

After learning about bitcoin, many people next start to consider bitcoin as insurance or a “hedge” on the existing financial system. Someone in this stage might think that if the dollar-denominated system were to go belly up, bitcoin could be the top contender to replace it.

People who invest 1% to 5% of their net worth in bitcoin likely are in the Insurance stage of personal adoption. With a 1% allocation, if bitcoin goes to zero, you’ve only lost a penny on the dollar. This would not be catastrophic to your financial future. However, if it grows 100x in purchasing power, you’ve protected everything else in the portfolio.

When protecting against the existing system, it’s important to remember that you need to get your bitcoin out of the system. Keeping bitcoin on an exchange or with a counterparty will do you no good if that entity fails. If you view bitcoin as insurance, it’s important to keep your bitcoin in cold storage and hold your keys. Otherwise, it’s actually someone else’s insurance.

“Bitcoin is savings.” – Pierre Rochard

In this stage, you might come to understand that bitcoin is not just insurance. Bitcoin helps people protect their purchasing power from inflation. Here, you might see that bitcoin is money and, therefore, a savings technology for your medium- to long-term goals.

The key to saving in bitcoin is to have a good handle on what your “free cash flows” are: your income, minus your expected expenses, equals your free cash flow. When the income and expenses are appropriately planned, savers can then dollar-cost average all or a portion of their free cash flows into bitcoin.

Dollar-cost averaging is a technique that helps you spread out your investment into bitcoin over time. It involves buying a certain amount of bitcoin on a regular schedule, regardless of the price. The most popular way to dollar-cost average is through an automatic purchase plan, where you set up an amount and schedule for buying bitcoin.

“Bitcoin is digital property.” – Michael Saylor

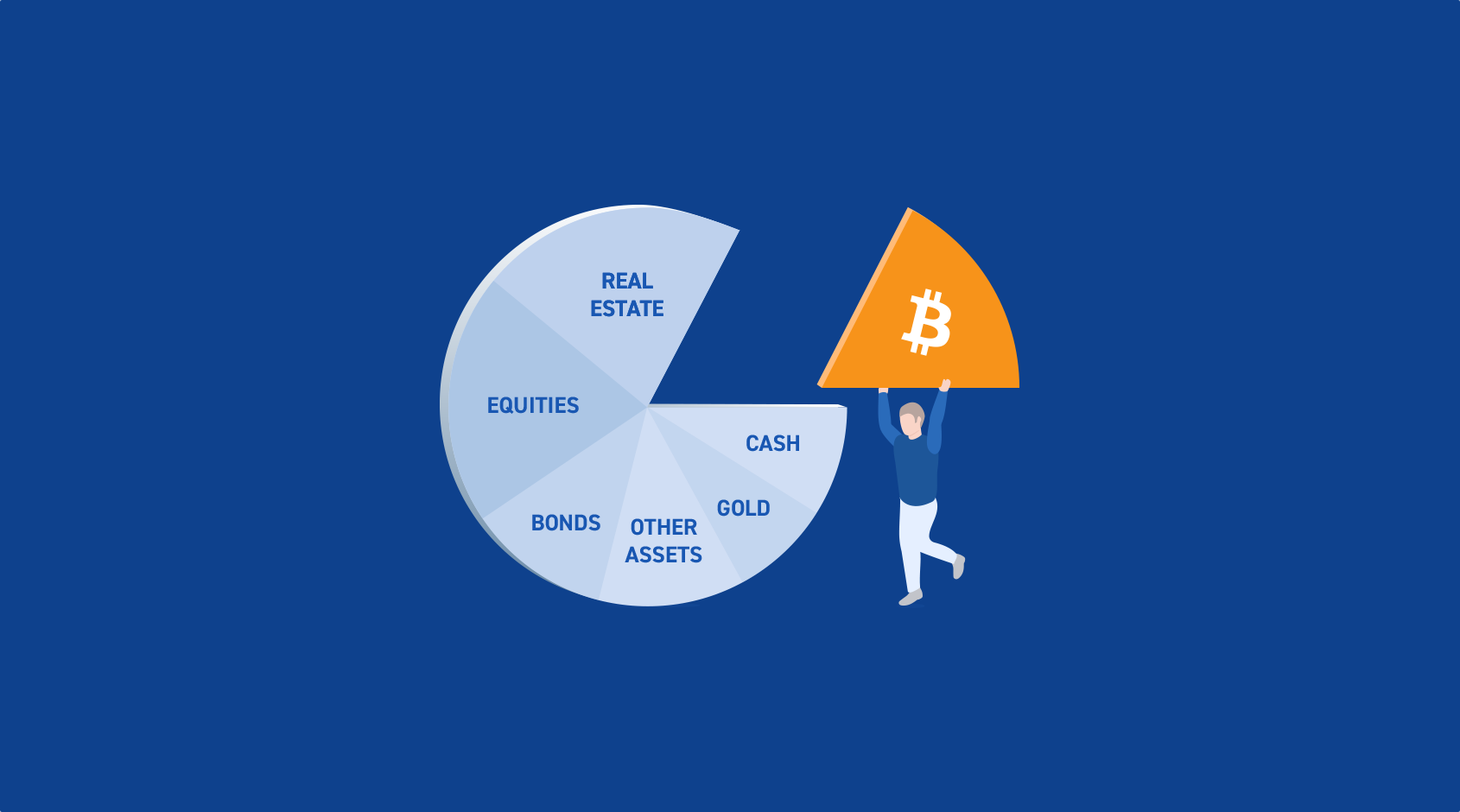

Bitcoin allocators tend to take a more active approach to investing in bitcoin. They internally think of bitcoin as a percentage of the overall picture (i.e. having 20% of net worth in bitcoin) and typically make decisions to buy or sell based on their investment strategy. This may involve lump-sum purchases or rebalancing their portfolio to maintain their desired allocation of bitcoin.

In other words, whereas bitcoin savers might save free cash flows, bitcoin allocators also invest existing portions of their assets.

Whether by a function of time or decision, bitcoin has a way of becoming a materially significant percentage of your net worth. As this happens, it’s natural to consider selling some bitcoin when it reaches a certain level of materiality. This may be due to a change in financial goals, risk tolerance, or investment horizon, or simply as a way to realize profits or reduce your exposure to the asset.

It’s important for individuals to carefully consider their reasons for buying or selling bitcoin and to assess the potential impact on their overall portfolio. It’s also important to note that the approach you take to investing in bitcoin, or any asset for that matter, is a personal decision that depends on your financial goals, risk tolerance, education, and investment horizon. These questions should be directed at a financial advisor.

“Bitcoin is time.” – Gigi

The effects of bitcoin are best represented over the largest possible stretches of time. By conserving time and energy into perfectly scarce money, bitcoiners in this stage focus on building and growing their wealth over the long term. However, sticking with a long-term outlook takes discipline, commitment, and a willingness to weather short-term market fluctuations.

Humans are often incentivized to focus on immediate rewards and outcomes, which can lead to the temptation to sell investments too early due to unexpected gains or unexpected losses. We are not naturally inclined to think in terms of decades. This is why products like individual retirement accounts (IRAs) can be helpful, as they encourage individuals to commit for the long term.

Investing in bitcoin with a long-term time horizon carries a certain level of risk. There is no guarantee that the asset will perform as expected over the coming decades. But, if bitcoin does what many bitcoiners in this stage of adoption hope and expect, it could drastically impact an individual’s life and net worth over the long term.

“Bitcoin is hope.” – Robert Breedlove

Bitcoiners in this stage are true believers in the transformative power of bitcoin. They see it as more than just a financial asset, but as a way to improve the world and bring about positive change. They are passionate about the potential of bitcoin to expand human freedom and create multigenerational wealth, and they are willing to take on significant risks in order to pursue these goals.

Despite the challenges and setbacks that may come their way, these bitcoiners remain committed to their vision. They are hardened by bear markets and are not deterred by short-term setbacks. They are in it for the long haul, with a focus on creating lasting wealth and a better future for themselves and those around them.

For some bitcoiners, this commitment even extends to eliminating fiat currency from their financial lives altogether. They are fully committed to the principles of bitcoin and believe that it is the best way to achieve their goals. Overall, these individuals are driven by a strong sense of purpose and a belief in the potential of bitcoin to change the world for the better.

Understanding the stages of your potential engagement with bitcoin can help you better align your personal goals with what bitcoin has to offer. Whether you are just learning about bitcoin, insuring against potential risks, saving for the future, allocating assets in your portfolio, committing to using it as a primary form of exchange, or enduring through any market fluctuations, hopefully gaining a solidified understanding of these perspectives can help you make informed decisions and better understand your own personal “why.”

This article is provided for educational purposes only, and cannot be relied upon as tax or investment advice. Unchained makes no representations regarding the tax consequences or investment suitability of any structure described herein, and all such questions should be directed to a tax or financial advisor of your choice.

Many of bitcoin’s staunchest critics have expressed doubt about its 21 million cap, but perhaps the most mindless criticism relates…

Ted Stevenot, Stephen HallWhen Satoshi Nakamoto created bitcoin, he established in its code a fixed number of bitcoin that will ever exist. Since…

Ted StevenotOriginally published in Parker’s dedicated Gradually, Then Suddenly publication. Bitcoin is often described as a hedge, or more specifically, a…

Parker Lewis