How does the bitcoin source code define its 21 million cap?

Many of bitcoin’s staunchest critics have expressed doubt about its 21 million cap, but perhaps the most mindless criticism relates…

,

In bitcoin, privacy is about having control over how and when you reveal your balances and transaction history when sending or receiving funds. For example, if you send bitcoin to someone, they can look up the address you used in the transaction and see how many bitcoin remain there. This is just one of many aspects to consider.

Privacy is the power to selectively reveal oneself to the world.

Eric Hughes, The Cypherpunk Manifesto

There are many entities to consider when protecting your privacy in bitcoin: wallet providers, exchanges, and criminals to name a few. Whether you want to minimize the personal information you share with wallet providers, hide account balances from friends and family, or protect yourself from social engineering, there are steps you can take to retain control over who knows what about your bitcoin.

Note that there is no one-size-fits-all solution, and bitcoin privacy ultimately can’t be completely solved, but here we’ll cover some ways to help improve your bitcoin privacy situation no matter your privacy concerns.

The most fundamental step you can take to improve your privacy if you already own bitcoin is taking self-custody. Taking self-custody means withdrawing your bitcoin from exchanges and custodians and learning to hold your own keys using a software wallet or a hardware wallet. Many of the other suggestions in this article are dependent on taking self-custody.

If you currently hold bitcoin with an exchange or other custodian, they necessarily track:

This can have obvious risks, and while institutions often allow you to request the deletion of your data, they are subject to regulatory retention and record-keeping requirements and will not be able to permanently delete them until those obligations are met (usually five years).

That said, even when you’ve withdrawn your bitcoin from an exchange, sometimes sharing information might be best for your circumstances. For instance, you may wish to use collaborative custody to get access to live support, financial services such as inheritance and retirement accounts (necessarily non-anonymous), and the enhanced security of a trusted co-signer.

Your ability to move funds is controlled by private keys, but your bitcoin live in addresses generated by those keys. These addresses are tracked on the bitcoin blockchain, which is a public record of every bitcoin transaction. If you share a used address with someone, they will know that any incoming or outgoing payments associated with that address belong to you.

There is no limit to the number of addresses your wallet can control, and there are great privacy benefits to always using a new address when receiving bitcoin. Tom Honzik went into detail on this topic in his article covering addresses and UTXO management (more on UTXOs in the coin control section below):

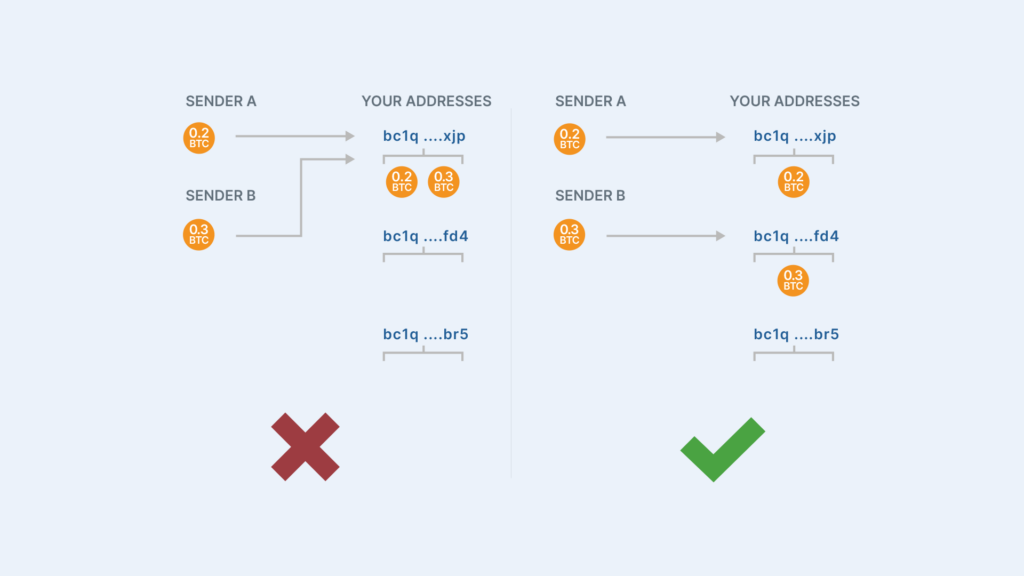

If you provide an address to Sender A and receive 0.2 BTC, and then provide the same address to Sender B and receive 0.3 BTC, both senders can see that you have received 0.5 BTC from multiple different sources.

Using a new address every time you receive bitcoin is basic practice for protecting your privacy, but it’s far from a silver bullet. There are many cases where you can still inadvertently reveal information, such as when you send bitcoin from multiple addresses in a single bitcoin transaction. Tom covered these and more in-depth in his excellent article.

tip: If you use a hardware wallet, you should always double-check your bitcoin address on the device before depositing funds.

Another basic practice for protecting your privacy in bitcoin is to separate your accounts.

Keeping separate accounts, structured as to minimize or totally eliminate transfers between accounts, allows you to put strict limits on the amount of data you share with third parties when making transactions.

One of the most simple examples is to keep a regular spending account separate from long-term savings. This model ensures that, no matter how poorly you might handle coin control (see next section), merchants or other recipients can’t trace your transaction history back to larger savings balances.

If you’re spending bitcoin frequently, or have significant bitcoin balances, you may want to consider further account segregation.

Most good wallet apps support creating multiple accounts in the same wallet. This enables you to avoid needing to set up more than one set of keys and seed phrase backups. However, sometimes a better approach is simply to use a different wallet app for each account, particularly when it comes to maximizing security. For example, a “hot” mobile wallet app on your phone for daily spending and an Unchained vault for long-term savings.

Coin control is a transaction technique that can give you even more granular control over what information you reveal about your balances and transaction history to the world. Many wallet app interfaces offer this as an “advanced” feature.

Put as simply as possible, coin control allows you to manually select the addresses you spend from when making a bitcoin transaction. This enables you to be intentional about what information you share with recipients about previous wallet deposits.

To really understand coin control, you need to understand UTXOs, which is beyond the scope of this article. In short, UTXO stands for “unspent transaction output” and represents the chunks of bitcoin controlled by your wallet. You can learn more about UTXOs in our article on the topic and our deep dive on how you can use coin control and CoinJoins to maintain privacy while using bitcoin.

As we covered extensively in our article comparing the many ways to buy bitcoin, some approaches are more private than others.

The options for purchasing bitcoin that maximize for privacy and anonymity are mining bitcoin yourself, peer-to-peer exchange, and buying bitcoin vouchers, but each have their own trade offs.

Buying bitcoin from an exchange is typically considered the least private method of acquiring bitcoin. Exchanges are required by law to keep a record of their users’ transaction history. This can put user information at risk of changes to privacy agreements, company buyouts, and data breaches. If customer data becomes exposed, users could be more vulnerable to social engineering attacks.

That’s the bad. The good is that, as we’ll discuss below, at least you roughly know who you’re sharing the data with.

For anyone taking this route to acquire bitcoin, you can marginally improve your data exposure by trying to find exchanges that minimize the number of third parties involved in the transaction, e.g., additional liquidity providers and KYC/chain analysis partners.

Mining bitcoin enables you to acquire bitcoin without providing personal information to any third parties. However, you’ll need expensive, specialized mining hardware and access to low-cost energy for this option to be remotely viable. Also, unless you’re running a large industrial operation, you’ll need to connect to a mining pool, which can carry privacy-leak risks if not handled correctly.

An alternative to buying bitcoin on a centralized exchange is to buy directly from another bitcoin holder. There are variety of options for achieving this, from using a decentralized exchange such as Bisq, or buying bitcoin in-person (e.g., at a bitcoin meetup).

The advantage of peer-to-peer purchases is the lack of digital records associated with your identity. However, the trade-off is you instead reveal sensitive information (such as your identity and bitcoin address) to individual strangers—unknown entities.

In-person trades are particularly risky if you are not familiar with the counterparty, due to an implicit awareness you will be carrying cash and/or bitcoin on your person. Therefore, extreme caution should be taken with this approach.

You can think of bitcoin vouchers as similar to “pay-as-you-go” mobile-phone vouchers, and only really suitable for purchasing small amounts of bitcoin. The way they work is quite simple: purchase the voucher at a retail store and scan the voucher’s QR code to redeem the bitcoin to your bitcoin wallet.

These require no account with personal information; you can pay with cash. The downsides of this approach: The vouchers require cash on hand, a physical trip to a store, and they’re typically limited to smaller denominations and have high fees.

To use bitcoin, you have to use a node. If you don’t use your own node, you’re using someone else’s. If you use someone else’s node, you’re trusting them with some amount of private data: personal data like your IP addresses, wallet addresses, and transaction history. Hence, another thing you can do to improve privacy is run your own bitcoin node and connect your wallet app to it. You could also use the node’s wallet itself, but this isn’t recommended for most people.

As with many other things in bitcoin, connecting to your own node has caveats. For one, not all wallet apps support node connections. Setting up a node can also take significant time. If you aren’t interested in running a node, the second best option from a privacy perspective is to use a wallet app that connects to a single node from a wallet app provider you trust. The least ideal situation is having your wallet app connect to random nodes or public servers, as is the case by default with wallet apps such as Sparrow and Electrum (although it is possible to manually configure connections to a node of your choice).

If you’re interested in learning how to run your own bitcoin nodes, you should read our introductory guide to bitcoin nodes and a collection of other benefits to running your own node.

The bitcoin Lightning Network is a second-layer network for opening payment channels between bitcoin users. To understand the privacy benefits of using the Lightning Network, you first need to understand how these payment channels work. A Lightning channel is essentially a contract opened between two individuals to move a set amount of bitcoin between those individuals many times until eventually deciding to settle the balance of that relationship to the bitcoin blockchain.

By keeping the status of the payment channel private between the two parties, they can move bitcoin back and forth in a way that is far less transparent than a typical on-chain transaction.

However, most Lightning transactions don’t happen within the confines of that relatively private relationship—they require routing through multiple channels using a “gossip network” (which is the network’s way of discovering routes by which to connect senders to receivers). The gossip protocol shares channel status data with many other Lightning nodes, which can result in you leaking information about your transactions and channel balances to third parties.

While the Lightning Network can be used to improve your privacy in some cases, Lightning privacy is still very much a work in progress and shouldn’t be counted on exclusively for now. In general senders on the Lightning Network are afforded more privacy than receivers. This is due to how Lightning currently handles invoices—which require receivers to disclose certain information about your Lightning node and payments channels publicly.

If you’re interested in the specifics of Lightning Network privacy, read this article in A Byte’s Journey. It offers a detailed look at how you can use Lightning privately and its shortcomings.

Certain tools allow you to physically transact bitcoin in the real world like you would with physical cash. These allow you to move bitcoin without broadcasting a transaction on the blockchain at all, which keeps your balances, addresses private. Using these tools, no one can peruse your transactions on the blockchain to learn things about you.

Popular tools include the Opendime and the Satscard, both from manufacturer Coinkite. Both devices essentially act as hardware wallets that enable you to send bitcoin to them, but not withdraw…at least not easily! Withdrawals can only be performed by physically breaking a resistor on the device (Opendime) or by running a permanent unlock command (Satcard). The validity of each device can be verified at any time online.

These devices aren’t a privacy panacea, though: they’re limited to a single denomination (you can add to the denomination but not subtract), which makes them difficult to use for real-world purchases. They also still require you to be thoughtful about the privacy of the coins you send to the devices. And you’d never want to hold a lot of bitcoin on one of these devices—the point is that there’s no backup!

Privacy ultimately means nothing if you lose your bitcoin, so taking self-custody should be your highest priority if you already own bitcoin. If securing your own bitcoin is new to you, learn more about the many reasons to use a hardware wallet for cold storage, some threats to look out for to prevent phishing, and some of the top tips for keeping self-custody bitcoin secure while traveling.

Many of bitcoin’s staunchest critics have expressed doubt about its 21 million cap, but perhaps the most mindless criticism relates…

Ted Stevenot, Stephen HallWhen Satoshi Nakamoto created bitcoin, he established in its code a fixed number of bitcoin that will ever exist. Since…

Ted StevenotOriginally published in Parker’s dedicated Gradually, Then Suddenly publication. Bitcoin is often described as a hedge, or more specifically, a…

Parker Lewis